cheaper car risks affordable cheapest car insurance

cheaper car risks affordable cheapest car insurance

Given that every state has its own motor car legislations as well as laws, rate rises aren't constant. affordable car insurance. And rates likewise vary depending on the extent of the mishap.

Also without thorough and also accident protection, your prices will raise from an at-fault accident. This is due to the fact that you, as a chauffeur, are still a threat.

vehicle insurance car insurance automobile affordable

vehicle insurance car insurance automobile affordable

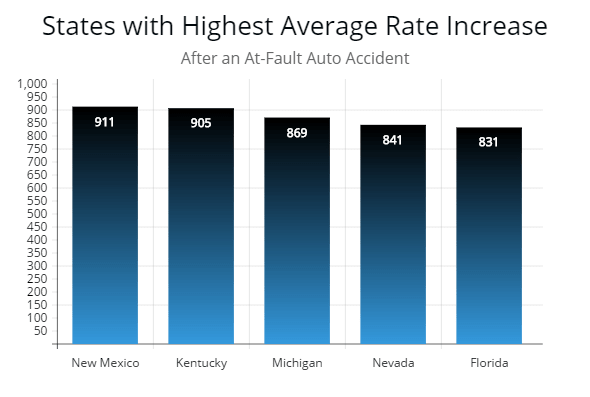

However also with a larger costs rise in general, you'll still pay a lot less annually than you would certainly for complete insurance coverage adhering to an accident. Ordinary annual premium with tidy driving history Ordinary yearly costs with one at-fault accident, States with the most affordable premium boost after an accident typically have laws that favor the motorist over the insurance company. insure.

If you have a $200 or $500 deductible, increasing it to $1,000 or even more can result in considerable financial savings. Only do so if you understand you 'd be able to pay the greater deductible in the event of a future claim. If you have full protection, consider going down collision and thorough.

The Best Guide To How Claims Affect Your Insurance Rate - I Drive Safely

Be aware, though, this is a high-risk way to cut expenses. Insurance providers utilize formulas to identify costs. low cost auto. One more insurance provider might give much less weight to your current mishap than your present one. If you desire to remain with your existing insurance firm, a fast phone call to your agent might disclose extra discount rates that can cut off some costs.

In the lengthy term, job toward ending up being a safer motorist, and additionally towards enhancing your credit rating. Both of these objectives will certainly imply lower prices in the future.

It is often difficult to state that's at mistake in a mishap, which may affect your price too. Partial obligation may require your insurance company to subrogate, or seek payment from the various other driver's insurance company as well as they may intend to pass that price on you. If your insurance company has positioned you in the high-risk group, our recommendations on lowering premium prices noted above may serve.

Purchasing around or opting for a risky insurer might provide you a lower rate. If you're questioning just how much insurance coverage rates raise after an accident, the answer is that it depends on your company, the state you stay in and also much more. The national ordinary boost for chauffeurs with full coverage is 34%; it's an also greater 44% if you have minimum protection (liability).

The Basic Principles Of 5 Factors That Impact Your Car Insurance Rate - The Personal

automobile liability cheap car suvs

automobile liability cheap car suvs

The boost ought to drop from your account in 3 years. Insurance coverage uses Quadrant Info Services to assess estimated rates from countless postal code in all 50 states, utilizing the top 15 insurance policy service providers to establish the ordinary vehicle insurance policy premiums. vehicle insurance. Quoted prices are based upon the account of a thirty years old male and also lady with clean driving records as well as great credit rating.

Everybody understands that an automobile accident can harm your insurance policy premiums equally as severely as the crash damaged your car. Average premiums can raise by thirty percent or more after a mishap (cars). Exactly how is all this computed? Price Basics Click for more Any type of quote for auto insurance coverage will begin with your driving record and the make and also model of your automobile.

cheaper car car insurance dui insurance

cheaper car car insurance dui insurance

Kind of Vehicle The more pricey the automobile is, the a lot more costly the insurance coverage will certainly be. This fact is just reflective of the higher price of fixings to an extra pricey car. Naturally, the extra expensive, greater horse power car is frequently driven by more youthful, much less risk-averse vehicle drivers, also adding to the base rate.

Driving History If you have had accidents or severe website traffic infractions, your insurance coverage prices will be substantially more than the base rate. The insurance firm will certainly ask about all of these products on the insurance coverage application and verify them by checking your driving background. If you have recent citations or accidents, be gotten ready for higher premiums. insurers.

See This Report on Why Do Car Insurance Premiums Go Up Every Year

An 18-year-old pays almost two as well as one-half times what a 25-year-old pays, as well as once they turn 26, the premiums will decrease by an additional 11 percent. So, What Does An Accident Do? Any auto mishap, also one that is not your fault, can boost your insurance policy premiums. automobile. Any unfavorable variables existing such as being at mistake or under the impact will just compound the increase (cheap insurance).

The premium boosts additionally differ by company as well as variety from a low of 10 percent with State Farm to a high of 36 percent with Amica. In various other words, there will be anywhere from a significant to a tragic boost in the amount of your premium (cheaper cars). And, it won't be for just one year.

In California, most accidents as well as small infractions impact your prices for three years. Much more serious issues can impact them for up to ten years. Even if you weren't to blame, if the damage was more than $1,000, you have to report the mishap, and also it will certainly impact your insurance policy. affordable auto insurance. In Florida, on the other hand, an accident strikes your record only if you were released a citation.

low cost auto low cost auto cars dui

low cost auto low cost auto cars dui

Massachusetts restricts factor to consider of an at-fault accident to no more than five years - laws. The insurance business may likewise pick just how lengthy it will factor an accident into your premiums, as long as it does not go beyond the state maximum. They resolve these problems by asking if you have had a mishap within a lot of years as well as, separately, whether you have had a DRUNK DRIVING, normally for a much more extended duration.

The Main Principles Of Accidents, Traffic Tickets And Auto Insurance

Yet, that again depends upon the state and the company. USAA, insurance company to the army as well as their households, says if they agree you are not responsible, your premium will not be influenced. Typically, any premium increase will only last for three to five years, as always, relying on the state and the company.

Other cases that can substantially affect your costs are at-fault accidents where the crash triggers you injury, at-fault mishaps where the car is amounted to, and uninsured chauffeur insurance claims. Crash Forgiveness Programs Many insurance firms supply vehicle drivers with a tidy history a mishap forgiveness program that permits at least one accident without a price increase.

This material is meant for basic details just. It does not increase protection past the plan agreement. Please describe your plan agreement for any specific details or concerns on applicability of protection - insurance.

Load full table of contents, As if recuperating from an accident isn't currently undesirable sufficient! The finest training course of activity is to shop about as well as look for a better rate. affordable car insurance.

The Best Strategy To Use For State Of The Car Insurance Market In 2022 - Marketwatch

If you want to locate out just how an accident can impact your vehicle insurance policy, read on. If you are not discovered at fault in the crash, your insurance coverage provider most likely will not raise your automobile insurance.